Condo Insurance in and around Chapel Hill

Get your Chapel Hill condo insured right here!

State Farm can help you with condo insurance

- Chatham County

- Siler City

- Fearrington

Your Search For Condo Insurance Ends With State Farm

Owning a condo is a lot of responsiblity. You want to make sure your condo and personal property in it are protected in the event of some unexpected damage or catastrophe. And you also want to be sure you have liability coverage in case someone gets hurt on your property.

Get your Chapel Hill condo insured right here!

State Farm can help you with condo insurance

Protect Your Condo With Insurance From State Farm

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Connie Fenner is ready to help you handle the unexpected with reliable coverage for all your condo insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If you have problems at home, Connie Fenner can help you submit your claim. Keep your condo sweet condo with State Farm!

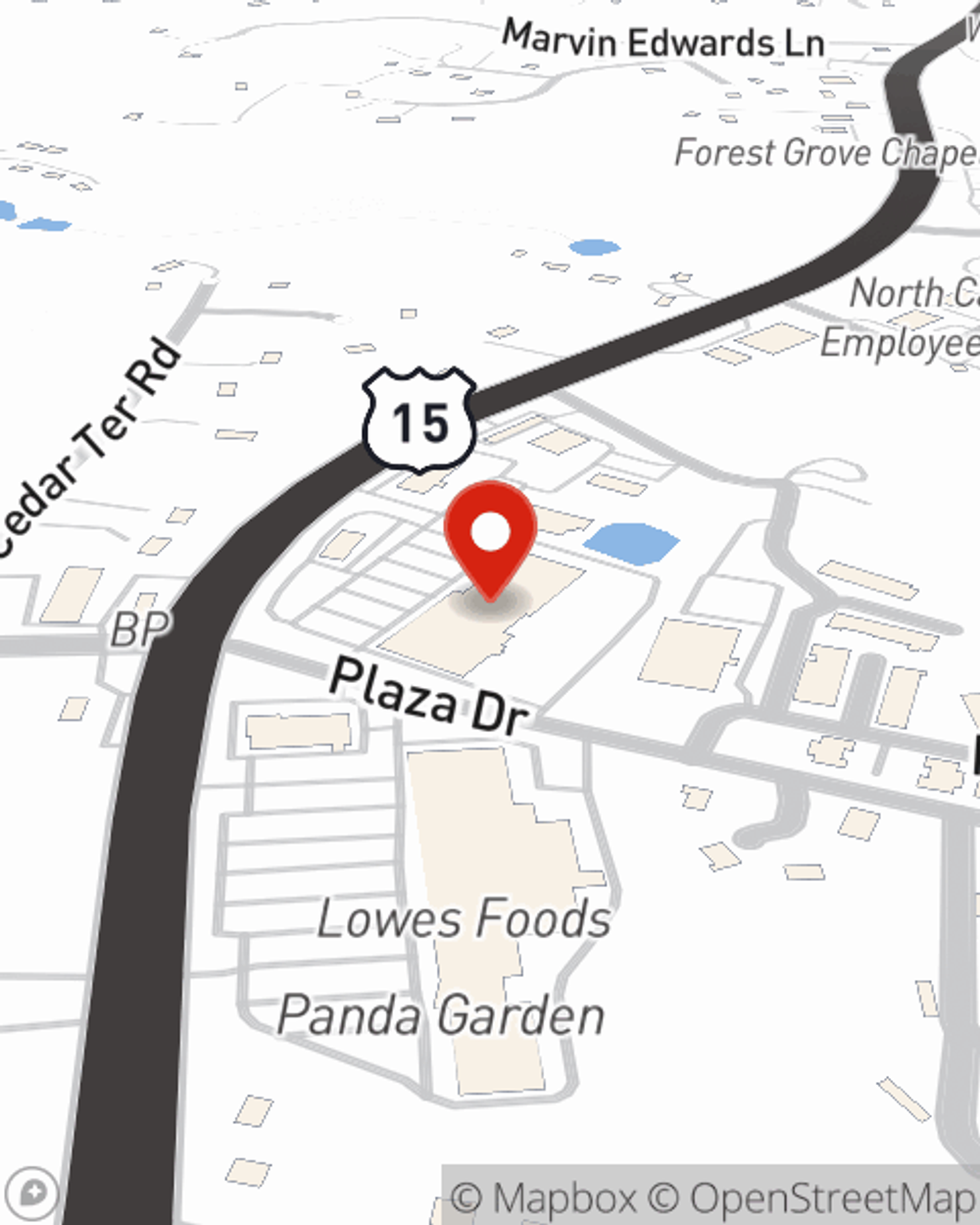

If you want to ask any questions, State Farm agent Connie Fenner is ready to help! Simply visit Connie Fenner today and say you are interested in this wonderful coverage from one of the top providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Connie at (919) 265-0702 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Connie Fenner

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.